Sizing Global Marketing: Expanding Opportunities and Outcomes

- POV’s

- November 18, 2019

- Brian Wieser

Key takeaways:

-

Companies around the world spend approximately $1.6 – $1.9 trillion annually on marketing; media accounts for approximately 40% of this total

-

Growth of marketing spending is likely similar to growth of media

-

All participants within the marketing industry can potentially look at this broader pool of economic activity as representing the resources available to marketers to drive top-line growth

-

Suppliers of media, products and services should look to identify the relative effectiveness of their offerings vs. other forms of marketing and encourage marketers to allocate resources as holistically as possible

Media should be viewed as a subset of marketing. Within the media industry, paid media is often studied in isolation from the broader marketing discipline it is a part of. Contextualizing media’s relative size and trajectory is a useful way towards better understanding its role. Unfortunately, doing so in numerical terms can be challenging because there are a myriad of ways that companies can market their products, and a similarly wide range of ways that companies can account for those efforts. For example, a manufacturer might consider a pop-up store to a marketing expense, as might a service provider who is developing a new product enhancement. They are not wrong to think in these terms.

Estimating the size and trajectory of the marketing industry is tricky. Rather than building “bottoms-up” supplier-based estimates of marketing spending (which would fail to capture spending incurred by marketers through their in-house labor and other costs) we have approached this problem by looking to see how much companies claim they spend on marketing relative to advertising. To the extent the companies we have included in our study are representative of the broader industry, with some confidence in our total advertising spending figure we can have some confidence in our marketing spending figure.

More specifically, we looked at companies who:

- Are either among Ad Age’s largest 100 global marketers or the largest 200 in the US

- Spend more than $0.5 billion on marketing annually

- Are publicly listed

- Disclose either a marketing-related or advertising expense and

- Provide internally consistent data for at least five years.

In total, we looked at 78 companies with a combined total of $5.2 trillion in most-recent fiscal year annual revenues. Among these companies, 16 provided both a marketing-related expense and an explicit advertising related expense (which we will refer to here as Group 1). In total, 35 disclosed a marketing expense item (and this grouping of companies will be referred to here as Group 2) while 59 disclosed an advertising expense item (this grouping will be referred to as Group 3).

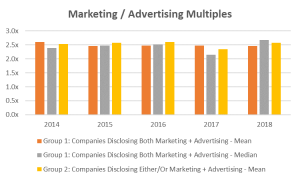

Total marketing = around 2.5x of total advertising. What we saw was clear:

- On a weighted average basis, Group 1’s marketing budget amounted to a relatively consistent 2.5x of advertising budgets (2.6x in 2014, but 2.5x in all other periods)

- Looking at the median company in Group 1 (to isolate whether individual large companies skewed the above results) we see more volatility with a range from 2.1x to 2.7x, but a generally similar ~2.5x range (and no clear trend over time, other than a slight dip in 2017 and a spike in 2018)

- Looking at the much wider field of companies (Group 2), the ratio of spending by all companies disclosing marketing expenses was between 2.4x to 2.6x the share of revenues allocated to advertising by all companies disclosing that figure. As with the Group 1 median, we saw a slight dip in 2017 and a spike in 2018

The “dip and spike” between 2017 and 2018 on two of the three measures we show here could mean that advertising grew faster than marketing in 2017 and then grew slower than marketing in 2018. However, the growth trend is not overwhelmingly conclusive, and so additional years of data will be necessary to assert that media is either growing faster or slower than the rest of marketing.

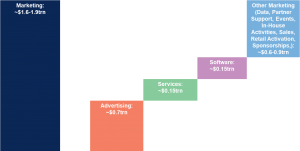

We can infer that spending on marketing amounts to around $1.6-1.9 trillion annually around the world. More broadly, the relative stability of the range provides some confidence about the size of marketing spending. Assuming the ratio of marketing to advertising holds up across the global economy, and assuming advertising accounts for $650-700 billion (depending on definitions of the industry used), we can say with some confidence that marketing accounts for somewhere between $1.6 trillion to $1.9 trillion globally.

As we have a good sense of spending on marketing related services (agencies and IT services consultancies focused on marketing) as well as software (marketing tech and ad tech) we can then estimate that spending on other forms of marketing amounts to a range of between $0.6-0.9 trillion per year. A total around this size is not overly surprising. What might be slightly surprising is that there was no clear trend in terms of the multiple rising or falling by much. This indicates that marketing is not necessarily growing much faster or slower than is media; conversely, it indicates that media is not necessarily growing faster than the rest of marketing is, despite the perceived advantages of an industry that is increasingly digital and performance-oriented.

Suppliers of media, products and services should look at their relative effectiveness in context of all marketing activities. Putting the wonkery of developing these sizing estimates aside, there are some important take-aways for the broader marketing industry. First, it is important to note that the total addressable market we estimate here represents the volume of resources made available to drive business growth through marketing. Second, individual sub-sectors within marketing (media owners, service providers, software companies and other external entities) should look at the potential for their own commercial activities through the lens of the size of the total marketing industry rather than the category they generally operate in.

For opportunities to expand for industry participants, marketers will need to improve the degree of flexibility they have in allocating the resources they require to support long-term business growth. At the same time, sellers of media, services and products need to continually improve the ways in which they identify how their offerings contribute to favorable business outcomes relative to other forms of marketing spending. Doing so will help to persuade marketers to become more flexible in managing total spending and related processes more holistically across the widest possible range of marketing activities.