GroupM Releases Results of Second Annual Survey on Consumer Attitudes Toward Technology

- POV’s

- January 4, 2022

- GroupM Business Intelligence

Study finds growing concern over data privacy, declining enthusiasm for new technologies.

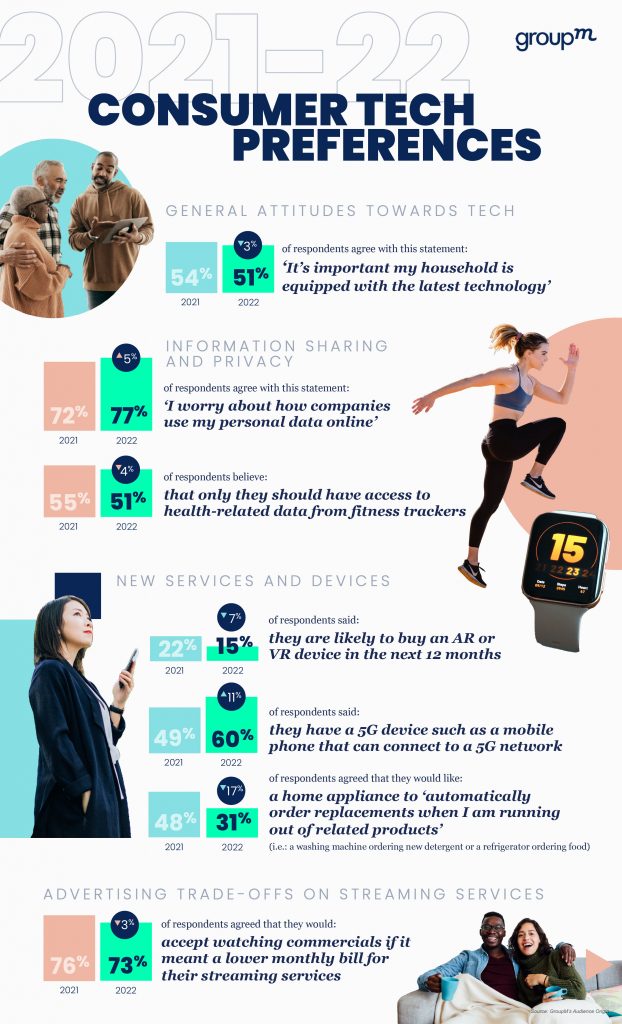

New York (January 4, 2022) — GroupM, WPP’s media investment group, is today releasing its second annual survey on consumer attitudes toward technology in the U.S. The results reveal increased concern about sharing personal data, declining interest in buying the latest tech products sooner rather than later, and greater numbers of people confused by technology and its promises overall. Conducted by GroupM’s Audience Origin (formerly LivePanel) in December 2021, this proprietary research surveyed one thousand U.S. consumers on their attitudes toward technology across six general categories: attitudes toward technology, information sharing and privacy, virtual reality-based devices and services, smart appliances, mobile devices and digital services, such as visual search, streaming audio and streaming video.

Survey respondents indicated some material shifts in sentiments around privacy, with greater numbers of people concerned about the use of their data online, fewer willing to share data associated with health trackers or allow smart appliances to automatically refill consumables. Fewer households now believe it is important that they are equipped with the latest technology and greater numbers profess to being confused by new technologies – which we can see in responses to questions regarding VR and AR device access or 5G access – with more saying they will wait until technology becomes cheaper before purchasing devices. Of more direct importance for the advertising industry, a shrinking majority of respondents (73%) said that they would accept having to watch commercials in order to maintain a lower monthly bill for streaming video services versus 76% in last year’s survey.

These trends reinforce the importance of data privacy to consumers and its implications for marketers—including the need to go above and beyond in securing consent from consumers when collecting or otherwise working with their data—to ensure that consumers experience real benefits from the use of that data and to always be mindful of how third-party data used in campaigns has been aggregated. The results also suggest that marketers could benefit from creating more clarity around how their technology products work and their practical benefits for consumers.

Finally, the increasing willingness of consumers to pay to avoid advertising in streaming video services reflected in this survey strengthens GroupM’s instinct that, over time, advertising will become a diminishing feature in this channel. This highlights the challenges that marketers will increasingly face in using TV for reach and frequency-based goals in the future: it will be increasingly important for marketers to either more directly manage TV budgets alongside their spending on UGC-based platforms such as YouTube or to look at the use of TV differently, managing budgets for related campaigns more directly alongside those intended for sports, culture, music or other event sponsorships.

RESEARCH HIGHLIGHTS

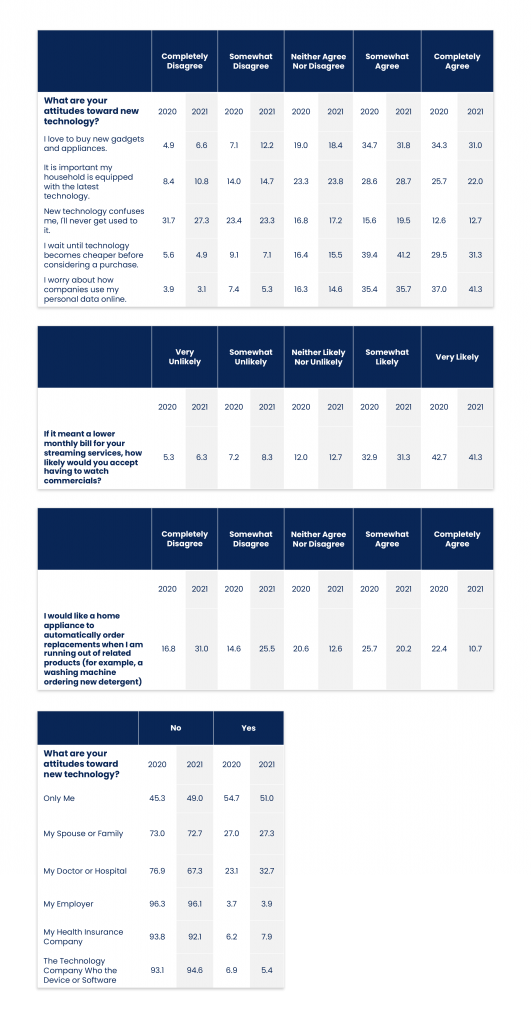

- General attitudes toward technology. 51% of respondents agree with this statement: “It’s important my household is equipped with the latest technology” versus 54% in our survey last year. 32% of the population somewhat or completely agreed that new technology “confuses me” in the new survey versus 28% last year. 73% agreed that they “wait until technology becomes cheaper before considering a purchase” versus 69% last year.

- Information sharing and privacy. 77% of respondents strongly or somewhat agree with the statement “I worry about how companies use my personal data online” in our most recent survey, up from 72% in last year’s survey. 51% of respondents believe that only they should have access to health-related data from fitness trackers. The comparable figure was 55% in last year’s survey. As with last year, only a small share of the population believes that the company that made the device or software should have access (5.4% this year versus 6.9% last year).

- New services and devices: VR/AR, 5G and Smart Device-Based Consumables. Virtual or Augmented Reality: 32% of respondents claimed to own a VR or AR device in our most recent survey, with 15% claiming they are likely to buy such a device in the next 12 months. Consumer perceptions of what, exactly, such a device is may not be commonly shared, as last year 39% claimed to own one, with 22% planning to buy one. Looking at 5G devices, 60% of respondents said they have a 5G device such as a mobile phone that can connect to a 5G network, up from 49% last year. Among the 40% of the population without a 5G connected device, more than a third expect to acquire such a device this year. As with VR/AR, consumer understanding of 5G may not fully match the reality of the product, as third-party estimates of shipments of rates of 5G devices in the United States major U.S. carriers imply substantially lower figures. In the world of smart devices, 31% agreed that they would like a home appliance to “automatically order replacements when I am running out of related products” (i.e.: a washing machine ordering new detergent or a refrigerator ordering food). By contrast, the comparable figure was 48% last year. While it is possible the driver of this sentiment change is related to a lack of satisfaction with related products, we also note that this trend is coinciding with greater concerns around privacy illustrated above.

- Advertising trade-offs on streaming services. Asked, “If it meant a lower monthly bill for your streaming services, how likely would you accept having to watch commercials?” 73% agreed with this statement in our newest survey versus 76% last year. Access to ad-free or ad-lite subscription services remains high, consistent with data observed through public filings made by the operators of streaming services.

SURVEY RESULTS