INTRODUCTION

Advertising has perhaps never been more top-of-mind or more in the public eye than it has been in the last six months.

Not only due to the recent wall-to-wall news coverage of the critical role it plays in underpinning the business of social media, but also because in a world beset by economic uncertainty, advertising has been thrust into the spotlight as a sort of bellwether for Big Tech and retail commerce. Held up to that light, the message is not altogether negative. We now believe that global advertising growth for 2022 will be 6.5%, excluding U.S. political advertising (what we call “underlying growth”). This is lower than our June forecast when we estimated 8.4% growth; however, this is primarily the effect of lowered China expectations. Ex-China, growth is forecast at 8.1% for 2022.

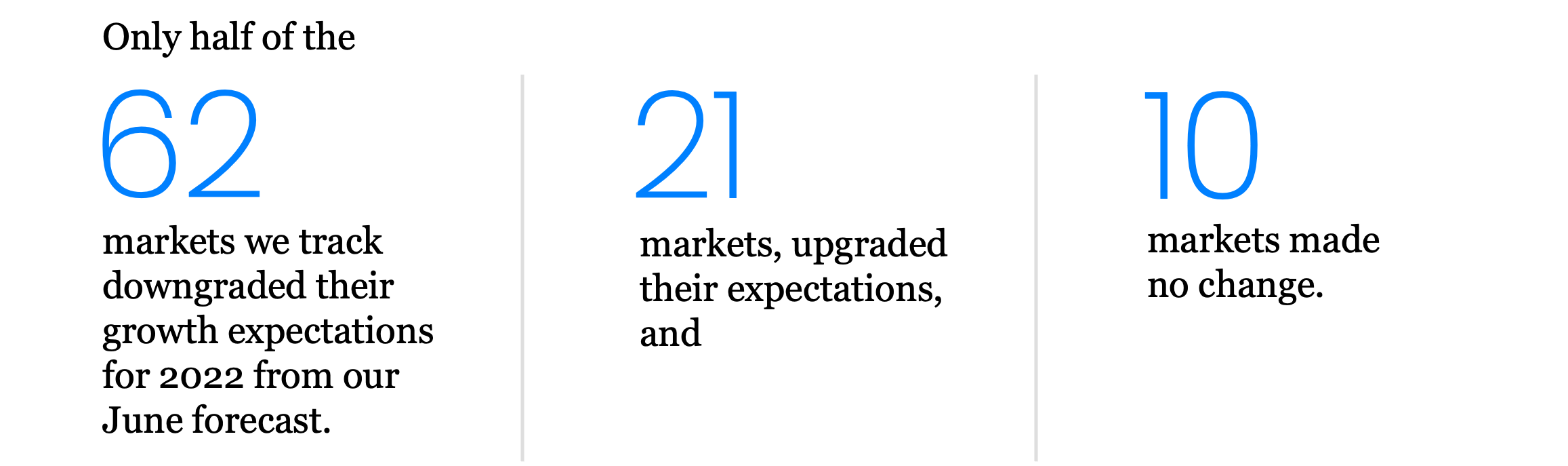

At the midpoint of 2022 it was difficult to gauge whether the early signs of economic slowdown would result in more mild or severe impacts to consumer spending, global supply chains and, ultimately, advertising revenue. Clearly, inflation has proved more intractable, as has the war in Ukraine. And yet, only half of the 62 markets we track downgraded their growth forecast for 2022. One-third, 21 markets, upgraded their expectations, and 10 markets made no change from the June forecasts. It’s also important to note that, when comparing last December’s forecast to this December’s, the U.S. dollar has appreciated considerably throughout 2022, which incrementally skews growth downward due to the higher weight of the U.S. advertising market and brings down the overall size of the global industry, at least when denominated in U.S. dollars.

Notably, only two of the 62 markets we track are forecasting negative growth in nominal terms (that is, without adjusting for inflation) in 2022. A majority of markets, 35, are forecasting growth, albeit below the average global rate of inflation this year, which is 8.8% per the International Monetary Fund (IMF) October 2022 World Economic Outlook. The other 25 markets are projecting growth above global inflation, and while some still fall below inflation levels in their own country (e.g., Argentina and Turkey), 16 markets are outpacing levels of inflation at home, including Australia, Brazil, India, Kenya, Malaysia, Mexico, South Africa and South Korea.

Looking at next year, when the IMF expects global inflation to drop to 6.5%, we see a similar trend with 26 markets predicting advertising growth above average global inflation, 32 markets forecasting nominal growth below the rate of inflation, and just four markets predicting nominal decline (Austria, Italy, New Zealand and Spain). Our global forecast calls for growth of 5.9% in 2023.

THERE ARE SEVERAL DRIVERS POINTING TO CAUTIOUS OPTIMISM

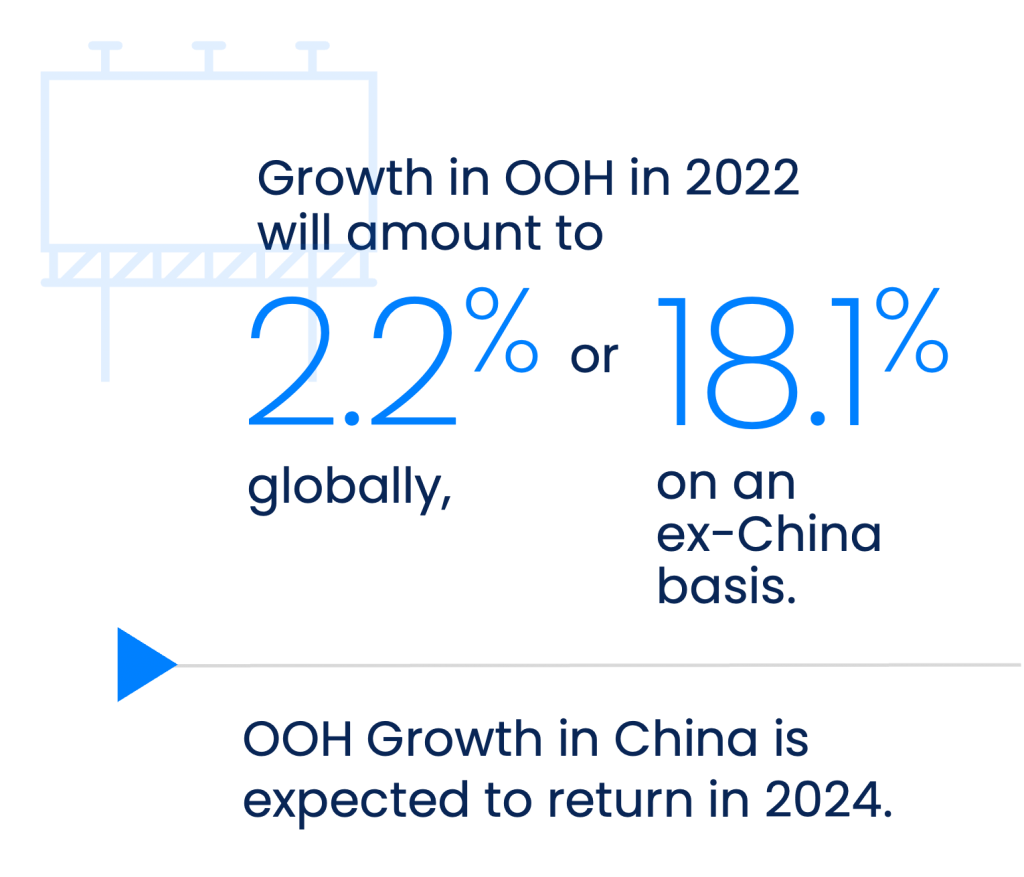

- Large declines appear limited to select channels in select markets. For example, Germany, France and the U.K. all downgraded 2022 TV growth from positive in our June forecast to negative in our end-of-year forecast. These markets are expected to face steep energy cost increases and shortages in light of the war in Ukraine. China’s out-of-home (OOH) figure for 2022 is set to decline more than 34.3% after the country’s zero-COVID policy has led to numerous restrictive lockdowns across the country.

- Large advertisers are cautious but recording revenue gains. For the most part, we have heard executives at some of the largest global advertisers voice concern about inflation and cost of living crises, but revenue has remained relatively resilient as companies pass on added costs to consumers and sales continue to hold up.

- Unemployment remains low and new business creation remains a source of growth. People, broadly, are able to find jobs, and new business creation, while falling in the most recent period in some markets, has been robust. These new businesses are likely advertising at higher levels than the businesses they have replaced in the economy.

- Digital, both pure-play digital platforms and digital extensions of traditional media, continues to grow. And despite recent headlines warning of a Big Tech bust and digital advertising slump, we expect both forms of digital advertising to grow double digits in 2022, ex-China.

DOWNLOAD REPORT

2022 GLOBAL END-OF-YEAR FORECAST

CLICK HERE TO DOWNLOADFor more information about specific markets outside of our Top 10, please email [email protected].

MACROECONOMIC BACKDROP: UNCERTAIN TIMES

The uncertainty and lack of easy precedents in the current macroeconomic environment are posing significant challenges for companies that, like people, don’t tend to enjoy ambiguity. Unlike the global financial crisis of 2007 to 2009 or the oil embargo recession of the early 1970s, which were both marked by high inflation and high unemployment in many nations, one must venture back to the 1940s and ‘50s to find a plausible analog for our current economic malaise. While no comparison is perfect, it can be illustrative to look at two post-war recessions in the U.S. when assessing the current environment. As the world’s largest economy and home to many of the world’s largest advertisers and ad sellers, these U.S. examples provide a useful, if limited, read.

During these periods after World War II and the Korean War, the U.S. economy was in a state of transition — weaning off the government-driven industrial production and stimulus money that flowed into the market. Prices in the U.S. increased 15% in the first half of 1946 alone as war-time price controls were lifted, returning soldiers drove up demand and global shortages of goods restricted supply. Sound familiar? Notably in 1946 the unemployment rate never rose above 5%, and the average for 1953 (following the Korean War) was 2.9%, eventually peaking at 6.1% in September of 1954 after the recession ended. These were also fairly mild recessions, with U.S. GDP declining 1.1% in 1947 and 0.6% in 1954, according to the Bureau of Economic Analysis.

One could make the argument that we are in a global post-COVID-19 “war” period marked by the after-effects of government fiscal policy and major supply chain disruptions, and not in a dot-com bubble type recession. That’s why we are not seeing the universal downturn — not yet anyway — of 2008 or even 2001, despite most companies reminding us that they are proceeding with an abundance of caution. It should be noted that 2022 is also marked by a real and continuing war in Europe. Individual markets in the region are facing more challenging trends through the end of this year and into next with no end in sight.

SOME THINGS ARE UNIVERSAL

Almost universally (outside of China and Japan), inflation has soared over the past year. The latest headline figure for the U.K. (as of October) is 11.1%, measured as year-over-year change. In Latvia, Lithuania and Estonia, the figure topped 20% in October. In the U.S., inflation growth has moderated following steep successive interest rate hikes by the U.S. Federal Reserve, and the latest October print of 7.7% was lower than expectations. Persistent inflation is expected to pose a continued headwind for consumers and manufacturers through at least the middle of 2023. Consensus estimates for inflation aggregated by financial data provider Refinitiv do point to significant improvements by the end of 2023, albeit still above central bank targets in markets like the U.S., U.K. and Germany.

HOUSEHOLD SAVINGS SUPPORT

Decelerating inflation over the next several months could mean sustained consumer spending and the avoidance of an advertising recession, arriving none too soon as the higher household savings we mentioned in our June forecast, which eased early inflation pressures at the end of 2021, have now largely evaporated. In the Eurozone, the household savings rate for the second quarter of this year dropped to pre-pandemic levels and, in the U.S., the September savings rate of 3.1% is the lowest it’s been since April of 2008 (other than June of this year when the rate dipped to 3% before rebounding temporarily). Australia’s household savings rate for the second quarter of this year fell to 8.7% from 11.1% in the same period of 2021. South Korea’s household savings rate (or surplus rate) was 34% in the second quarter of this year, down from the first quarter, but up from 28% a year ago.

UNEMPLOYMENT REMAINS LOW

As mentioned above, this spate of high inflation hasn’t come with universally high unemployment, and mixed wage gains add to the ambiguity around what sort of recession may or may not be at hand. In October, the IMF forecast China’s GDP growth at 3.2% for 2022, the second lowest level since 1977. This likely has more to do with the government’s restrictive zero-COVID policy and associated lockdowns than typical recession drivers like unemployment, which stood at 5.4% in July (albeit with a record-high figure for youth employment of 19.9%, according to the National Bureau of Statistics). In the U.S., recent wage gains reversed. October data showed a year over-year decline of 3.7% in real average weekly earnings, but this is coming at the end of a decade- long period where the lowest earners saw wage growth often ahead of inflation. The labor market has remained strikingly robust despite interest rate increases, with unemployment in the U.S. standing at 3.7% as of October.

Persistent inflation is expected to pose a continued headwind for consumers and manufacturers through at least the middle of 2023. Consensus estimates for inflation aggregated by financial data provider Refinitiv do point to significant improvements by the end of 2023, albeit still above central bank targets in markets like the U.S., U.K. and Germany.

WORKFORCE REDUCTIONS

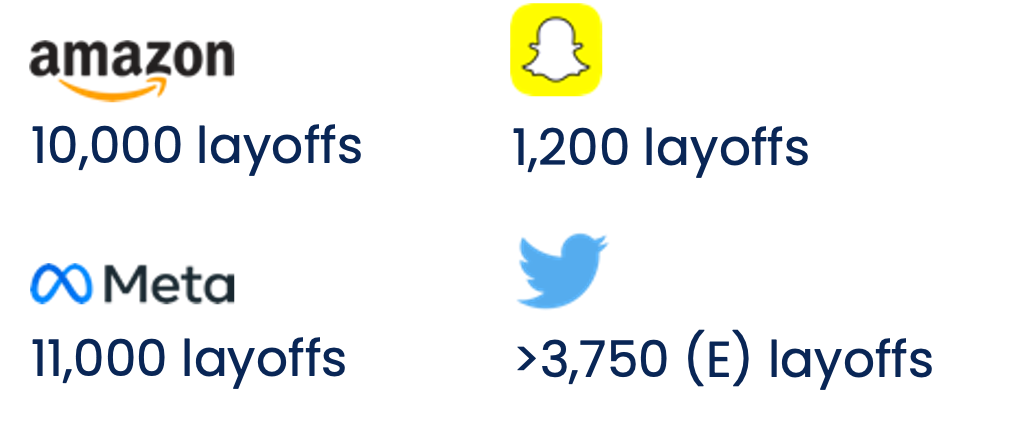

The decline in unemployment rates doesn’t mean there haven’t been workforce reductions. Throughout the second half of 2022, there have been hiring freezes and layoffs reported at a number of advertising companies, and while, in the case of Twitter, the scale of the layoffs may have a detrimental impact on the platform’s ability to service its customers, for the most part these labor market contractions are neither surprising nor a direct read-through to the state of advertising itself. Mark Zuckerberg, CEO of Meta, said it himself in a letter regarding the recent layoffs. He had expected the consumer behavior and business conditions of the pandemic era to continue and hiring at the social media network ramped up to support that over the last 12 months.

Combined, Meta, Google and Amazon grew advertising revenue by 39% in 2021 on a constant currency basis, and the tide lifted TV as well, which reversed six years of flat or declining revenues to grow 13% in the year. But as government stimulus funds have dried up and as people returned to spending on traveling and dining out, rather than gaming and eating at home, the advertising growth accompanying those pandemic conditions has decelerated and resulted in operating and capital expenditures that have grown more quickly than revenue in 2022. Hence, layoffs. Broader layoffs and hiring freezes can also be seen as a sign that central bank monetary tightening efforts, i.e., interest rate increases, are having the intended effect: As the cost of capital goes up, corporate investment slows, cooling demand and the economy at large (or so the thinking goes).

DECELERATION OR DECLINE?

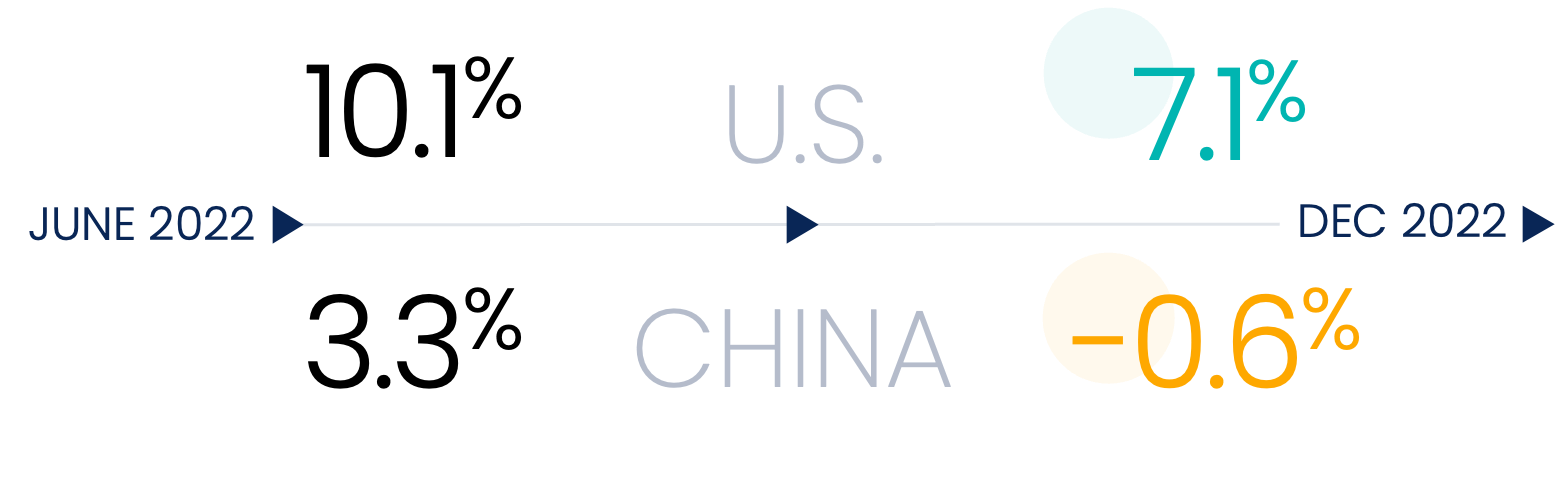

We are projecting nominal (or non-inflation adjusted) global advertising revenue growth in 2022 of 6.5%, a significant deceleration from the 24.4% growth observed last year and a downgrade from our June forecast of 8.4% growth. The difference between our current estimates and the June forecast can primarily be explained by changed expectations for China, which has gone from 3.3% growth to 0.6% decline, and for the U.S., where we now predict 7.1% growth (excluding political advertising) versus 10.1% in June. These two markets will make up 55.5% of all advertising revenue in 2022, and lowered expectations therefore impact global totals.

Of the other top 10 tracked markets, five will grow ahead of inflation (Australia, Brazil, France, India and Japan), while four will grow slightly behind country-level headline inflation (the U.K., U.S., Canada and Germany). In addition to China, only Sri Lanka, where a cost-of-living crisis persists after mass protests led to the president’s resignation in July, is expected to record a nominal decline.

China and the U.S. will make up 55.5% of all advertising revenue in 2022."

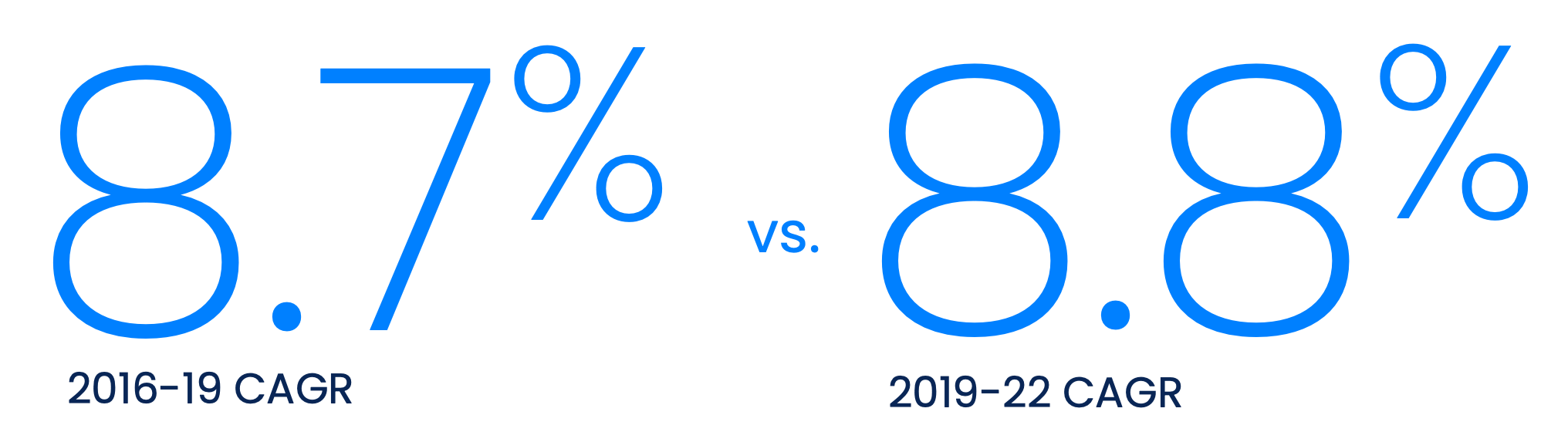

It can be useful, given the significant up-and-down swings of the last two years, to look at advertising growth on a three-year compounded basis, essentially smoothing out the volatility of the pandemic. And despite headlines portending the doom of Big Tech and advertising, we estimate the three-year compound annual growth rate (CAGR) for total advertising at 8.8% for 2019 – 2022, practically identical to the 8.7% rate for the previous three years (2016–2019).

That said, of the three major secular drivers of advertising growth we discussed in our June forecast (Chinese advertisers, digital endemics and new business formation), two are currently under some duress.

CHINESE COMPANIES ADVERTISING OVERSEAS

We have noted the often overlooked and hard to quantify impact of Chinese companies advertising overseas. For the last six years, Meta has listed China as one of the top sources of revenue, despite the social network not having any users within China. Amazon and Walmart have also been beneficiaries of Chinese manufacturers selling goods on international e-commerce platforms.

The extent to which Chinese advertisers will continue to fuel advertising revenue growth over and above global GDP growth likely depends on two factors: the domestic market (how well consumer spending holds up through ongoing COVID-19 lockdowns and a housing market slump) and the extent to which the Chinese government continues to levy fines and impose regulations on internet giants like Alibaba, Baidu, Tencent and Bytedance.

If the domestic market slows, but so do government scrutiny and fines for Chinese advertisers, then we may expect more growth in overseas advertising (assuming ports and factories remain able to produce and transport goods). If domestic demand picks up and companies are incentivized to focus nationally rather than internationally, or if continued COVID-19 lockdowns persist into next year, we are unlikely to see growth at the same pace of the last six years.

DIGITAL ENDEMICS

We believe another secular driver of growth has been the rise and disproportionate advertising spending of digital endemics, defined as companies whose business is primarily online. For our purposes we include Amazon in this definition, despite the increasingly physical presence they occupy. Other digital endemics include online travel booking, dating, sports betting, ride hailing and fintech companies. These companies tend to be higher intensity advertisers — that is they spend more on marketing and advertising than the businesses they have replaced in their sectors, sometimes pouring upwards of 50% of revenue into sales and marketing activities.

There is also an element of maturation among this group that has likely led to deceleration in advertising growth.

Digital endemics could afford this “grow at all costs” mindset while the cost of capital was cheap, but as central banks globally have raised interest rates this year, venture capital funded companies and newly public companies have had to become more conservative, and we have seen a significant deceleration in sales and marketing expenses across this category. There is also an element of maturation among this group that has likely led to deceleration in advertising growth.

Digital endemic advertisers (excluding the travel and sports betting companies that have maintained sales and marketing budget growth this year) will have almost certainly been missed by those publishers reporting softer advertising revenue or advertiser pullback. Meta mentioned early in the year that e-commerce was their largest sector, and retail digital endemics recorded year-over-year declines in sales and marketing expense from the third quarter of 2021 through the second quarter of 2022.

NEW BUSINESS FORMATION

Newly formed businesses, which we believe are a third key driver of advertising spending, have proven to continue to be remarkably resilient. In the U.S., the number of new businesses formed through the first nine months of 2022, while down from pandemic-era highs, was still 45% higher than pre-pandemic levels. In the European Union, new business registrations were also up 3.5% in the first nine months of 2022 versus the same period in 2019. However, in the U.K., we note that new business births are now behind levels seen in 2019 and business deaths have increased, pointing to the weaker economic climate there.

2023 OUTLOOK

We now expect global advertising to grow 5.9% in 2023, behind the IMF’s expectation for global inflation of 6.5% and a downgrade from our 6.4% June estimate. Of the largest markets responsible for the majority of growth in the previous two years, the economic outlook is decidedly mixed. In the U.K., GDP is currently forecast to decline 0.6% in 2023, while estimates for inflation remain above Bank of England targets at 6.5%. In China, estimates place GDP growth at 5.0% (an improvement over 2022’s expected 3.1% growth). In the U.S., the likelihood of a recession fell to 54% in mid-November, down from an October high of 64%. Barring an escalation of the war in Ukraine or another COVID-19-sized global disaster, we expect growth to climb mildly in 2024 to 6.2% before returning to a trend of decelerating mid-single-digit growth through 2027.

We now expect global advertising to grow 5.9% in 2023."

MAIN STREAM

Television has historically been the first consideration on any large advertiser’s marketing plan due to its unmatched ability to drive reach. Brand builders have used TV to drive awareness and get their message in front of new potential customers who are incremental to loyal buyers. And because of the (relatively) high production cost of creating TV ads, it has meant that:

- Large brands with big budgets account for most tv advertising,

- Marketers generally prefer to appear next to high quality (professionally- produced) content as they seek to borrow the brand equity of content to build their own brands, and

- TV campaigns have a sufficiently broad message to appeal to any number of potential customers in a one-to-many approach.

But what happens if it becomes impossible to reach a majority of the population in any given market with television-based campaigns? Or if content production is democratized and atomized to the extent that performance campaigns vastly outnumber brand campaigns and short-form amateur video creators replace TV’s cultural touchstones?

As the quality of linear TV content diminished ... brands' preferences to appear next to professional content faded.”

To answer these questions, we can turn first to China where linear TV saw average reach for all day parts fall to 46% in 2021, severely limiting its ability to fulfill the reach-based goals of marketers. The solution for many marketers in the near term is mixed reach —activating and measuring campaigns across not only linear and connected TV but also online video and OOH video inventory.

How Did It Get To This Point?

In the last five to 10 years, as the quality of linear TV content diminished and as TV ad load limitations and new subscription-based streaming services limited available inventory, brands struggled to reach audiences in the medium. The need to appear next to professional content faded and marketers embraced social commerce sites offering millions of potential brand ambassadors all creating short-form video.

With production costs reduced in the switch to short-form content, the door was open to advertisers of all sizes, including the “store brands” of the platforms themselves. And as campaigns fragmented across numerous creators incentivized to drive sales, anthemic brand messages gave way to performance-based personalization. This characterization, simplified as it is, has implications for markets worldwide. We estimate that the vast majority of advertising in China has a performance, rather than a brand-building goal, habituating many marketers in China to the closed loop measurement found on social commerce sites like Pinduoduo.

In tracking metrics such as likes, reposts and direct sales, marketers have found a partial substitute for reach and frequency, long relied on as leading indicators of sales.

It is not hard to see the pattern beginning to form in other markets as well. In the U.S., in the closing months of 2022, streaming providers have claimed virtually all the most-watched TV programs other than live sports, which is still dominated by linear networks and cable channels. But as Apple, Amazon and other non-traditional players enter the market for sports rights, even this last bastion of linear viewership won’t be guaranteed. Sports alone certainly haven’t been enough to stem the losses of video customers from cable and satellite providers. We estimate that pay TV penetration, including multichannel video programming distributors (MVPDs) and virtual MVPDs (vMVPDs) will fall below 50% of U.S. TV households in 2025.

By 2025, all pay TV providers combined will reach fewer than half of homes in the U.S."

As time spent and advertiser dollars move to social networks and short-form video platforms in addition to connected TV, the content experience will be driven increasingly by algorithms and/or one’s personal network, resulting in the atomization of media.

Traditional TV reach is declining in most markets, especially among younger audiences, and some clients are already budgeting for TV alongside connected TV and, in some cases, YouTube. This will not be the case in every market today — in some countries free-to-air TV is better able to satisfy reach goals than in others. But it seems reasonable to assume that if there is a relationship between share of spending on content and share of viewing, that those reach and frequency goals will continue to fall off everywhere. This will be especially true in markets where a majority of the audience is accessing content via ad-free or ad-light subscription services.

Just how pervasive these subscription services become will depend on that share of spending on content mentioned above. While we note that Amazon, Comcast, Disney, Netflix, Paramount and Warner Bros. Discovery each spent upwards of $12 billion in 2021 on content, the current economic environment has resulted in some additional focus on profitability in the near term, which could constrain content spending growth on streaming services. Hence it is unclear how the pace of streaming content investment will continue, but we do believe it will continue to grow over time.

MEDIA TRENDS

In our June forecast, we downgraded our global advertising growth estimate from the December 2021 figure of 9.7% to 8.4% — a change primarily driven by deceleration in China, which made up 20% of total advertising revenue in 2021. Expectations for China have now deteriorated again, from our June market estimate of 3.3% advertising growth to an expected contraction of 0.6% this year. This, along with pockets of reduced expectations in markets like the U.S., put our current estimate at 6.5% global growth in 2022, decelerating in 2023 to a 5.9% increase, albeit with stronger gains in connected TV, retail media and some fast-growing markets like India.

Advertising is expected% to expand 5.9% 5.9 in 2023 with stronger gains in CTV, retail media and fast-growing markets like India.”

DIGITAL

Global pure-play digital advertising is now forecast to grow by 9.3% in 2022, lower than our June forecast of 11.5%. This growth comes off the back of 31.9% growth in 2021 and brings the overall share of digital advertising (not including spending by advertisers on digital extensions of traditional media) to 67% of the industry total this year. We expect that share to rise to 73% by 2027.

Retail media, one of the fastest growing segments of the advertising industry, is now estimated to reach $110.7 billion dollars in 2022, an upgrade from our September forecast of $101 billion. This channel has likely been a beneficiary of shifts in offline to online retail advertising as well as budget from other media owners to retail media networks (note the advertising revenue outperformance of some retail players such as Amazon in the third quarter of 2022 versus declines at some less commerce-focused platforms). But shifts alone are likely not enough to explain the growth of this medium, where we see two sources of current and future incremental growth within individual markets: spending from overseas merchants, notably China, and new, non-retail-endemic advertisers adding retail media either through direct buys or via existing programmatic vendors as an audience buy.

Outside of retail media, we expect digital revenue including search, video and display to decelerate from double-digit growth to mid-single-digit growth over the next five years as the channel reaches maturity in more markets. TikTok (as measured independently from parent company Bytedance in China) is likely to roughly double revenue in 2022. This has likely been another driver of the advertising deceleration or “pullback” noted at Meta and Snap (e.g.) over and above macroeconomic factors given that we see less deceleration across other digital platforms where TikTok would be a less obvious alternative (such as Microsoft).

However, it is important to note that government scrutiny within India (where TikTok remains banned), as well as the U.K., U.S. and European Union is intensifying as the company makes clear, or is not able to deny, that TikTok employees in China have access to data from the accounts of citizens in those markets. Marketers may choose to view the platform as a good way to reach younger audiences who are becoming increasingly difficult to target via linear TV, with the caveat that longer term strategies or investments come with increased risk of the platform being banned in additional markets.

Retail media, one of the fastest growing segments of the advertising industry, is forecast to reach $110.7 billion this year, an upgrade from our September forecast of $101 billion."

Twitter, too, remains an open question for many marketers because of the erratic product updates at the company and mercurial nature of new owner Elon Musk, who told staffers that bankruptcy is a possibility, as reported by Bloomberg. Despite its outsize role in certain news, political and media spheres, the platform represented just 1.2% of all global digital ad revenue ex-China in 2021. Its size means Twitter is not a must-buy for the majority of advertisers, and while any spend coming out of the platform in the last three months of this year may not be reinvested due to macroeconomic concerns, TikTok, Reddit, Pinterest and others may benefit in 2023 as long as scale and product offerings ramp up to support advertiser needs. What may be less easily replicated on other channels is the organic nature in which brands use Twitter to engage with audiences on a mass-reach platform.

Advertisers, for their part, will be keen for any brand-safe, scaled and innovative platform offering diversification beyond Google and Meta, which are set to capture 47.2% of all advertising (not just digital) in 2022, ex-China.

TV

Television continues its recovery to pre-pandemic levels, albeit more slowly in 2022, with an expected global growth rate of 1.7% (excluding U.S. political advertising). We expect growth to remain between 1%-3% over the next five years as connected TV grows double-digits, narrowly offsetting declines in linear TV in markets including much of Western Europe, the U.S., China, Malaysia, Taiwan, Singapore and most of Latin America, excluding Brazil.

It’s plausible that in 2021, connected TV inventory drove incremental growth from new TV advertisers. As we now move past the boom year of 2021, we expect the vast majority of connected TV growth to come from shifting shares of existing TV budgets. We do not expect the launch of ad-supported tiers from Disney and Netflix to be a significant factor in 2022.

Ongoing declines in traditional TV viewership paired with increasing levels of cord-cutting continue to compromise the utility of the medium that marketers historically relied on to reach broad audiences with their campaigns. YouTube and, perhaps increasingly, short-form video platforms may offer marketers a plausible addition for video-based campaigns, especially for those less concerned with borrowing the brand equity of the content where their ads run. For others, media that have historically been used for local campaigns in a given market (e.g., OOH or audio) may offer opportunities for broad reach alongside live sports and other tentpole moments.

OUT-OF-HOME (OOH)

Growth in global OOH this year will amount to 2.2% globally (excluding U.S. political spending), or 18.1% on an ex-China basis. China, the largest OOH market for the last six years, has faced numerous city-wide lockdowns this year as a result of the government’s zero-COVID strategy, limiting the potential reach of outdoor advertising. Growth in China is projected to return in 2024, however the channel is not projected to regain pre-pandemic levels within the next five years. Globally, OOH will surpass 2019 levels in 2024, with some markets like Brazil, Australia, France and the U.S. already above 2019 levels in 2022.

Digital OOH, despite making up a smaller share of the inventory in most markets, now represents 30%-40% of revenue at OOH companies like JCDecaux and Clear Channel Outdoor.

AUDIO

Audio is projected to grow 3.8% globally in 2022 (excluding U.S. political advertising) and decelerate to 1.3% growth in 2023. Digital audio now represents nearly a quarter of total audio advertising revenue and is forecast to grow by double-digits in both 2022 and 2023. This growth will roughly offset the decline of terrestrial radio through 2027. Podcasts, while generating interest and experimentation among publishers and marketers, remains difficult to measure effectively which may constrain future growth.

After a brief respite in 2021, traditional print continues its decline of 7.4% in 2022. Print-based media will decline by 3.7% when including digital extensions, which are forecast to make up nearly half of total revenue this year and more than three-quarters of revenue by 2026. Continuing its current path of low single-digit decline over the next five years, print revenue will fall to near parity with OOH in the year 2027. That said, there is recognition among many in the industry that support of responsible journalism remains an intrinsic function of advertising, especially in an era of misinformation across social networks. Publishers, for their part, are diversifying their offerings and revenue streams with the addition of podcasts, affiliate programs and improved audience matching capabilities.

POLITICAL ADVERTISING

Last, but certainly not least, as it’s six-and-a-half times the size of cinema advertising this year, we look at the impact of political advertising. In 2022, we estimate that U.S. political advertising will add $12.6 billion dollars to the overall industry ($13.6 billion including direct mail). This total, for a mid-term year, is only $500 million or so behind the figure for the 2020 presidential election year, and up an astonishing 90% over the previous mid-term elections in 2018.

Local channels including TV, OOH and audio are large beneficiaries. Digital, and increasingly connected TV, are also finding political to be an important source of revenue, especially with younger candidates and issue spending (as opposed to campaign spending).

TOP 10 MARKET DATA

UNITED STATES

The U.S. economy has proved fairly resilient, walking the line between incurring enough “pain” to appease the Federal Reserve in their quest to curb inflation, but not tipping into a recession.

TV and digital advertising make up the vast majority of U.S. ad revenue. Advertising on pure-play digital platforms, despite decelerating growth in 2022, continues to increase its share and will account for two-thirds of total ad revenue within the next two years. Retail media is the fastest growing component of digital and is expected to reach $33 billion in 2022. Currently we expect connected TV to grow double-digits over the next four years and make up nearly a third of all TV advertising revenue by 2027.

We expect connected TV to make up nearly a third of all TV advertising by 2027.”

OOH has enjoyed robust growth and will surpass 2019 revenue levels in 2022. Further growth is likely to hinge on OOH providers’ ability to digitize not just their inventory but also their operations and to align offerings with marketers that, we believe, are increasingly oriented nationally rather than locally.

Audio, newspapers and magazines combined will account for just 11.2% of all U.S. advertising revenue in 2022. Declines in terrestrial audio will be offset in 2022 by gains in digital audio, which is likely to represent a third of the total medium. Print, including newspapers and magazines, will see declines despite single-digit digital growth. Magazine sellers have been hit hard this year with increased paper costs due to a paper mill strike in Finland during the first half of the year as well as increases in postal rates. Some magazine companies have sought premiumization — increasing paper size and/or weight alongside higher rates for subscriptions and advertising.

CHINA

China has seen far greater economic impact from the COVID-19 pandemic in 2022 than was expected at the outset of the year. This acted as a drag on consumption and ultimately led to our lowered forecast of -0.6% growth of advertising revenue in 2022. With the 20th CPC national congress complete, China seeks a path out of COVID-19’s shadow and its own new normal. More policies aimed at boosting the economy are expected going forward and ad revenue growth will rise to 6.3% in 2023.

China’s advertising industry is dominated by the internet. Digital was nearly 90% of total revenue in 2022, and the channel still recorded growth in line with inflation this year. Going forward, the double-digit growth seen over the past two decades will be difficult to regain as internet penetration and time spent plateau.

Policies aimed at boosting the economy are expected going forward and ad revenue growth will rise to 6.3% in 2023."

Adding to the calculus for key platforms such as Alibaba, Bytedance and Tencent are tacit agreements reached with the government this year following a series of anti-monopoly campaigns launched by the government in late 2020 aimed at these and other internet giants. Those restrictions were relaxed midway through 2022

as the digital platforms demonstrated cooperation with the government and realigned business expansion strategies. Over the next five to 10 years, growth will be driven by e-commerce as well as international expansion.

OOH, hit by COVID-19-related lockdowns again and again, is experiencing its darkest hour as revenue this year is just above 2015 levels. The decline is expected to end in 2023 before the channel returns to growth in 2024. Other traditional media, such as TV, radio and print, face further audience erosion and a continued shift to digital content. Without any major events in 2023, they will all see revenue contract, unable to sustain their current share of spend.

JAPAN

While Japan faces similar geopolitical pressures to other parts of the world, inflation and interest rates remain low with inflation rates of 3.7% and negative interest rates of -0.1% (as of October 2022). With signs of the global economy slowing down and becoming more uncertain, broader headwinds are impacting Japan’s recovery from the pandemic as the Q3 2022 figures show a 1.2% decline in real GDP growth relative to last year. Although the economy benefits from strong export growth and government support on consumer spending, a weaker currency, declining real wage growth and widening trade deficit amid global headwinds appear to be producing a drag on growth.

For 2022, we estimate Japanese advertising revenue will grow 7.0%, with that figure decelerating to 4.4% in 2023."

For 2022, we estimate Japanese advertising revenue will grow 7%, with that figure decelerating to 4.4% in 2023. This growth is led by pure-play digital advertising, which accounts for the largest share (57.9%) in 2022 and is expected to continue rising above pre-pandemic levels. TV advertising, representing the second largest share at 27.9%, is expected to grow 1.6% this year, driven by strong double-digit growth in connected TV post-pandemic.

UNITED KINGDOM

Despite attempts to distance itself from the rest of the continent, the economic situation in the U.K., at present defined by sticky high inflation of 11.1% and fears of a prolonged recession, has hinged in no small part on the country’s vicinity to the war in Ukraine, a common European energy market and ongoing labor and trade challenges post-Brexit.

After a tumultuous summer that saw the transition to a new British monarch and two new prime ministers, the U.K. has regained some of its footing with the pound increasing against the dollar from its low at the end of September, and full year 2022 GDP growth is estimated to reach 3.5%. Our forecast for advertising revenue growth in 2022 is 8.9%, with that figure decelerating to 5% in 2023.

For 2022, we estimate Japanese advertising revenue will grow 7.0%, with that figure decelerating to 4.4% in 2023."

Digital pure-play platforms, a medium set to account for 80% of total ad revenue this year will grow 11%, outpaced by retail media (a subset of digital), which we forecast will reach £6.5bn by 2027.

TV remains a distant second to digital in the U.K. and, despite the ongoing double-digit year-over-year growth of streaming ad-supported video, is expected to remain broadly flat over the next five years. The World Cup in November and December will not be enough to offset losses in TV share and viewing this year.

OOH continues its post-pandemic recovery with 30.4% growth in 2022 and will surpass 2019 levels in 2024. Radio will rise above pre-pandemic levels in 2022. Newspapers and magazines by contrast are maintaining their decline, estimated at -4.3% in 2022 and -9.1% in 2023.

GERMANY

The IMF estimates real GDP growth of 1.5% in Germany in 2022 (as of November), followed by a contraction of 1% in 2023. Good performance in the first half of the year hasn’t offset some of the declines in areas such as linear TV in the second half of 2022.

We now predict Germany will finish 2022 with 5% nominal growth of advertising revenue (boosted somewhat by inflation as in other markets). Growth in 2023 is forecast to improve to 6.7%, even as inflation expectations are lower at 4.4%.

A look at the forecasts for individual channels in 2023 reveals that OOH (set to grow 5%), and digital (at 13% growth) are key drivers of German ad revenue.

Within digital, retail media will play an increasingly important role in 2023, with forecast growth of 12.8%.”

Within digital advertising budgets, retail media will play an increasingly important role in 2023, with growth forecasts of 13% in line with the broader digital channel, while search will grow slightly faster at 15%.

We estimate radio will grow 1.9% in 2023 (including digital extensions) on a nominal basis. Television will be faced with declining revenue in 2023 and is expected to contract by 2.4%, on top of a 5.4% decline in 2022.

Going forward TV will face added pressure to maintain its share of total ad revenue as minimal gains of 2% for TV digital extensions won’t be sufficient to offset a 3.5% dip in linear TV.

Print media are also expected to suffer losses. Newspapers will contract by 7% in 2023 while magazines will fall by a similar 5%.

FRANCE

The French economy remains relatively resilient despite the geo-political context and the impact of long-term inflation on the economy. GDP growth is expected to stabilize in the final months of the year, leading to an annual rate of 2.5%, driven by the first part of the year.

Media investment has followed a relatively similar trend, with a very dynamic start to the year, followed by a slowdown from May onward, and then a real deceleration during the third quarter.

Our forecast for 2022 is 7.6% growth, lower than the June forecast of 11.1%. Television is showing a decline and is expected to end the year at -1.8% in its traditional form and at -0.5% including digital extensions.

Digital pure-play platform growth has decelerated from 2021 across all its segments, with retail remaining the fastest-growing through 2027.

We anticipate a deceleration of growth in 2023 to 6.3% with a focus on media that delivers short term efficiency and return on investment.”

For 2023, uncertainty remains, but we expect a weak start to the year, with a recovery expected mid-second quarter, depending on the evolution of the international context.

We anticipate a deceleration of growth in 2023 to 6.3% with a focus on media that delivers short term efficiency and return on investment. As a result, 100% of the estimated growth is expected to be in digital media, particularly performance-based media and retail.

TV and OOH are expected to recover, in particular due to a base effect, but also thanks to the deployment of new solutions around segmented TV, connected TV and DOOH. Press and radio are expected to decline, a consequence of budget arbitration by advertisers who are forced to make choices.

We predict that 2023 will be a transitional year, in the positive sense, before a more dynamic 2024 with growth of 9.5% driven by the Paris Olympics.

CANADA

The Canadian economy currently faces an environment with high inflation and rising interest rates driven by supply-chain disruptions and rising commodity prices following the Ukraine-Russia war. Relative to other G7 countries, inflation is slightly lower and has decelerated from earlier this year to 6.9% (as of October 2022). Overall, economic growth is expected to slow with the IMF projecting 3.3% real GDP growth in 2022 declining to 1.5% in 2023.

Retail media is forecast to reach more than $2.6 billion in 2022 and is expected to grow 15.3% in 2023.”

Within this uncertain backdrop, advertising revenue in Canada is forecasted to grow 5.8% during 2022, with that figure further accelerating to 8% in 2023. This growth is led by pure-play digital advertising, which accounts for the largest share (72.8%) in 2022 and is expected to continue rising above pre-pandemic levels. Retail media (a subset of digital) is forecast to reach more than $2.6 billion in 2022, declining slightly versus 2021 before returning to growth of 15.3% in 2023.

TV advertising, representing 12.9% of advertising market share, is expected to grow 6.6% this year. There is a continued progressive shift from linear to connected TV and an increase in connected TV inventory, despite the cost of TV (while inflated) being lower than some of the connected TV options available.

BRAZIL

At a time where high inflation and rising interest rates are key challenges facing the global economy, Brazil’s economy is also transitioning to new fiscal policies under a new president. Overall, economic growth is expected to slow with the IMF projecting 2.8% real GDP growth in 2022 declining to 1% in 2023.

During 2022, total advertising revenue is expected to grow 9%, with that figure decelerating to 3.8% in 2023. This growth is led by pure-play digital advertising, which accounts for the largest share (44.7%) in 2022 and is expected to continue rising above pre-pandemic levels. TV advertising, representing 39.8% of advertising market share, is expected to stay broadly flat with 0.6% growth in 2022.

Retail media in Brazil is expected to grow 18% in 2023, following 25% growth in 2022.”

Brazil is by far the largest LATAM market and maintained its eighth ranked position this year, but it’s forecast to be overtaken by India in 2023.

Contrary to other large markets, newspapers will remain roughly flat through 2023 and 2024 before returning to decline in 2025.

Retail media, a subset of digital revenue, is forecast at more than $170 million in 2022 and is expected to grow 18% in 2023, following 25% growth in 2022.

INDIA

India’s economic outlook appears to be stronger relative to other markets with the IMF projecting a real GDP growth of 6.8% in 2022, positioning it as one of the fastest growing economies in the world. Fiscal policy drivers, such as improved investments in digital infrastructure, a growing labor force and becoming an attractive exporter, partly explains its strong growth. Like many of its global peers, the Indian economy is also facing uncertainty amid wider geopolitical risks, enduring inflation pressures from a weak currency, high unemployment and high interest rates.

India's GDP growth of 6.8% positions it as one of the fastest growing economies in the world.”

Against this backdrop, our advertising revenue growth forecast for 2022 is 15.8%, with that figure further accelerating to 16.8% in 2023. This growth is led by pure-play digital advertising, which accounts for the largest share (48.8%) in 2022 and is expected to continue rising above pre- pandemic levels. Retail media in India is forecast at $551 million in 2022 and is expected to nearly double by 2027. TV advertising, representing 36% of advertising market share, is expected to grow 10.8% this year and continue growing double digits, driven by strong growth in both traditional and connected TV.

AUSTRALIA

Australia, like the rest of the world, is experiencing challenging economic conditions including inflation, energy cost increases, production shortages and rising interest and mortgage rates. The IMF predicts real GDP growth of 3.8% in 2022 and 2.1% in 2023.

Low unemployment, robust consumer spending and stored-up savings are mitigating forces in the market, which we estimate will expand 10.9% in 2022. However, the forecast for 2023 stands at 3.4%.

The revenue growth of digital pure-play platforms during the pandemic has continued into 2022, albeit at a slightly slower 14.8% rise. Global media platforms and retail media are key contributors and should see ongoing single-digit growth over the near-term.

TV will grow 3.7% in 2022 driven by connected TV. While linear TV will increase in 2022, it may be the last year of expansion as connected TV takes over a larger share TV revenue. Total TV in 2023 is expected to record a small overall decline of 0.2%.

Connected TV is the key driver of TV growth and it's possible that 2022 will be the last year for linear growth.”

Audio will grow 6% in 2022, rivaling 2019’s pre- COVID-19 revenue. Further advancements in the ongoing expansion of podcasting and streaming audio will drive growth in coming years. Revenue in 2023 is expected to grow 1%.

The return of the Australian population to work and social interaction contributed to growth of 27.1% in OOH, including 29.7% growth of digital OOH. In 2023, supported by programmatic activation, OOH will reach a new revenue peak, up 11.3% over pre- pandemic levels in 2019.