Exclusive Data from COMvergence on Media Agency Billings Final 2020 Reveals Top Global Agency Network and Group Winner

- Press Release

- July 26, 2021

- COMvergence

OMD Remains the Leading Global Media Agency Network and GroupM the Largest Group in 2020

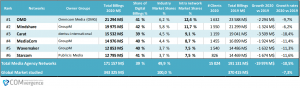

FRANCE — JULY 21, 2021 — COMvergence has issued its latest global billings rankings report based on Final 2020 media agency and group billings – including digital media spends. With a total 2020 billings figure estimated at $21.3B, and a growth rate of -9.7%, OMD stays as the top ranked media agency network worldwide. GroupM’s Mindshare (including Neo) placed 2nd with $20.0B (-6.2%) and Carat ranks 3rd with $15.5B (-18.4%).

Media Agency Networks Final 2020 Global Ranking

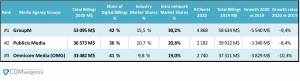

At the Group level, WPP’s GroupM remains a strong global leader with 15.5% industry market share (and 30.2% intra-Big 6 group share) and $53.1B in global billings, down by -9.4% vs. 2019; followed by Publicis Media ($36.6B, down by -8.4% vs. 2019) and Omnicom Media Group ($33.5B, down by -10.3% vs. 2019).

Media Agency Groups Final 2020 Global Ranking

KEY FINDINGS

All the major agency networks have posted a negative global growth rate 2020 vs. 2019, ranging from -6% to -7% for Mindshare, Havas Media and dentsu X to -18% for Carat and Essence. The average growth rate 2020 vs. 2019 among the 19 media agency networks is -10.5%. The same applies to the big 6 media agency groups, with negative growth rates ranging from -6.1% for Havas Media Group to -15.4% for dentsu international.

Looking at the independents, COMvergence assessed the 60 largest local media agencies which together represent a total billings figure of $20B (or 10% of the total billings controlled by all agencies assessed globally). Horizon Media (US) is by far the largest worldwide independent with a total billings figure 2020 of $7.2B, hence about a third of the independent total billings.

Digital Media billings represent on average 39% of the media agency networks’ total billings (vs. 36% in 2019) – this rate varying from 31% for Zenith to 63% for Essence. Variations are less significant at a group level as the average digital share ranges from 36% for Havas Media Group to 42% for GroupM.

The total estimated billings 2020 handled by the media agency networks (including standalone/dedicated client units and agencies, operated by the big six holding companies) as well as the major independent agencies reached about $196B across 45 markets [excluding Brazil] representing 95% of the global media investments covered by COMvergence. It also stands for 57% of the global net media spend that COMvergence estimates at $343B in 2020 (vs. $370 in 2019; -7.3%). The remaining 43% being handled by smaller independent media agencies, digital specialized agencies, Japanese and Chinese local advertising agencies, or in-house units operated by the advertisers (especially in the digital area).

The total media spend of $343B studied by COMvergence breaks down by region as follows: North America (38%), APAC (34%), EMEA (26%) and Latin America (2%).

COMvergence has recorded a total media spend reviewed of $25B in 2020. Hence that is about 13% of the total billings the agency networks as well as studied media independent agencies controlled globally.

# # #

COMvergence is an independent and international research consultancy providing analysis and benchmarking studies of the advertising and media firms owned by the global marketing services groups, leading independent agencies, and management & IT consulting firms. Using quantitative and qualitative measurement metrics, COMvergence provides high-quality reference data, guidance and support for MarCom professionals across all levels and titles. COMvergence partners include the American Association of Advertising Agencies (4A’s), World Federation of Advertisers (WFA), Nielsen and Kantar, among others.